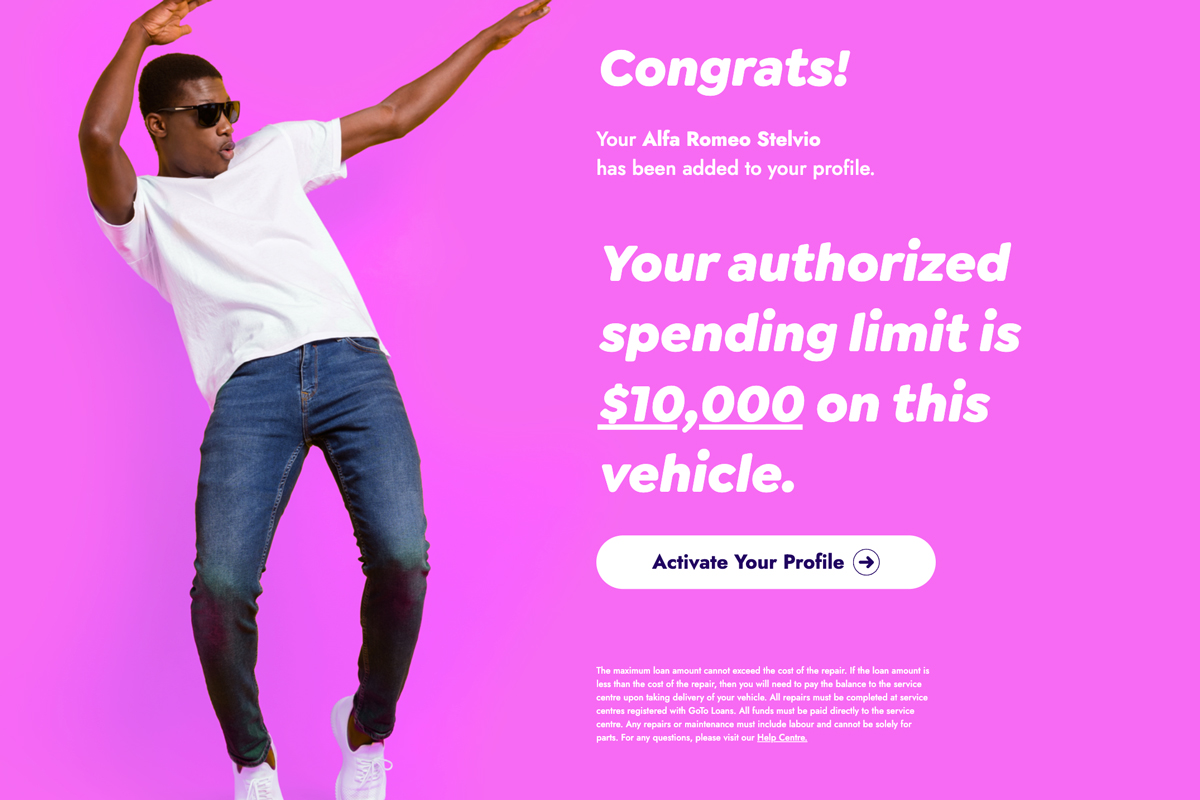

Repair Now,

Pay Later

At Wippy, we know that when you love your vehicle, it turns daily drives into memorable journeys. That’s why we believe everyone should be proud of their ride, and that’s why 95% of vehicles entered qualify for a WippyPay Payment Plan. Let us get you back where you belong – on the road.